Microsoft Stock Slides Sharply as AI Investment Concerns Grow

• Shares fall nearly 12%

• $360–$400 billion wiped off market value

• Investor confidence shaken over AI spending

Microsoft shares suffered a steep decline, plunging nearly 12 percent in a single trading session, marking the company’s worst day since March 2020, during the height of the COVID-19 market crash. The dramatic sell-off erased approximately $360 to $400 billion from Microsoft’s market capitalisation, sending shockwaves through Wall Street. Investors reacted strongly to concerns that Microsoft’s massive investments in artificial intelligence may take longer than expected to generate meaningful returns. The drop highlights growing skepticism about whether Big Tech’s AI spending spree will deliver short-term profitability.

Software Industry Sell-Off Deepens Market Anxiety

• Broader tech stocks under pressure

• AI infrastructure costs questioned

• Nasdaq and S&P 500 retreat

Microsoft’s decline was not an isolated event. The sharp fall triggered a broader sell-off across the software and technology sector, as investors reassessed the sustainability of heavy AI-related spending. Major US indices, including the Nasdaq Composite and the S&P 500, also moved lower as technology stocks came under pressure. Market participants are increasingly shifting their focus away from long-term growth narratives toward more immediate concerns such as cash flow discipline, margins, and return on investment. The AI boom, once viewed as a rising tide lifting all tech stocks, is now being scrutinised more carefully.

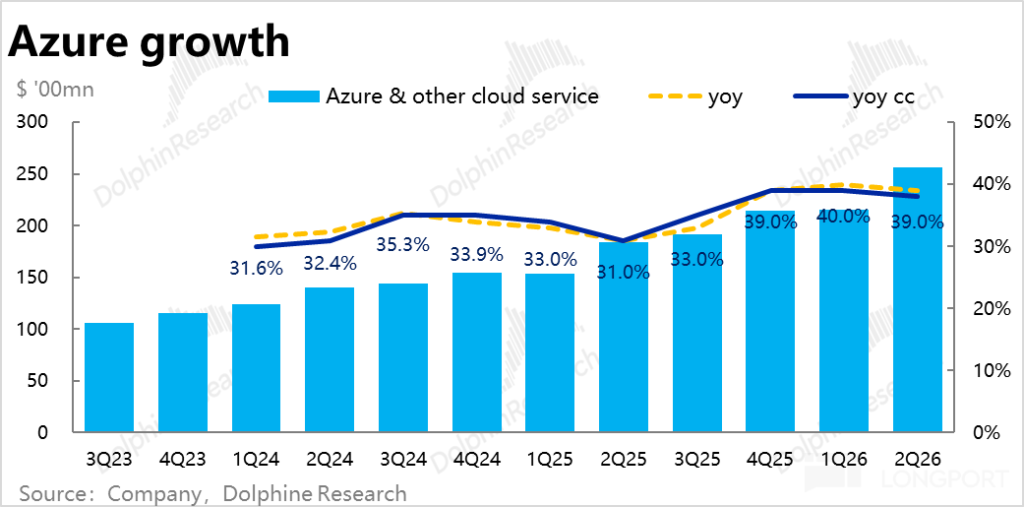

Azure Cloud Growth Slows, Raising Red Flags

• Growth below expectations

• AI chip constraints impact performance

• Questions over future momentum

One of the biggest concerns for investors was a slowdown in Microsoft’s Azure cloud computing business, which is central to the company’s AI strategy. While Azure continues to grow, the pace has moderated compared with previous quarters. Microsoft attributed part of the slowdown to capacity constraints related to AI chips, which have limited the speed at which new AI services can be deployed. The company forecast Azure growth of 37% to 38% for the January–March period, but investors remain uncertain about whether growth can reaccelerate in the coming quarters.

Record AI and Data Centre Spending Alarms Investors

• Capital expenditure up 66% year-on-year

• Quarterly spending reaches $37.5bn

• Monetisation timeline remains unclear

Microsoft revealed that its capital expenditure surged 66 percent year-on-year, reaching a record $37.5 billion in a single quarter. The majority of this spending is being directed toward AI data centres, cloud infrastructure, and computing capacity needed to support large-scale AI models. While Microsoft insists this investment is necessary to secure long-term leadership in AI, investors are increasingly concerned about the lack of clarity around when these investments will begin to pay off. Wall Street is now demanding clearer evidence of AI monetisation rather than long-term promises.

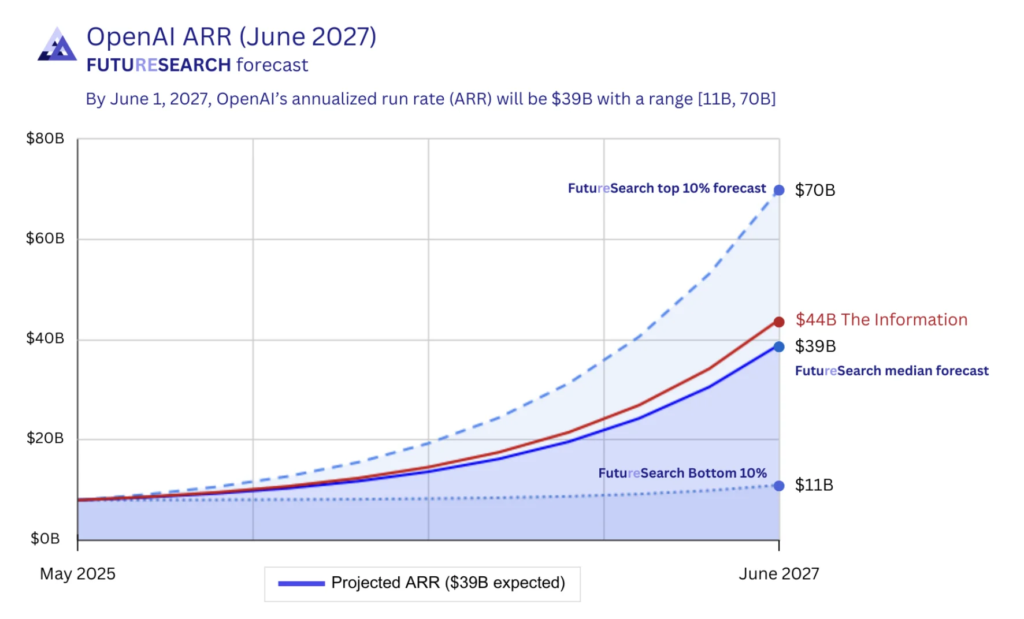

Heavy Reliance on OpenAI Raises Concentration Risk

• 45% of cloud backlog linked to OpenAI

• Concerns over exposure and financial risk

• OpenAI losses add to uncertainty

Microsoft’s close partnership with OpenAI, while strategically important, has become another source of investor anxiety. The company disclosed that 45 percent of its cloud backlog is tied to OpenAI, highlighting a significant level of dependence on a single partner. Reports suggest OpenAI carries nearly $100 billion in debt, and Microsoft may invest an additional $10 billion into the AI startup. Investors worry that any slowdown in OpenAI’s growth or funding challenges could directly impact Microsoft’s cloud revenues and AI ambitions.

Intensifying AI Competition Adds More Pressure

• Google Gemini and Anthropic gain traction

• OpenAI faces growing challenges

• Innovation costs likely to rise

The competitive landscape in artificial intelligence is becoming increasingly intense. Rivals such as Google’s Gemini and Anthropic’s Claude have gained positive traction, forcing OpenAI to play catch-up in certain areas. Reports indicate OpenAI has internally declared a “code red” as competition accelerates. For Microsoft, this means continued high investment not only in infrastructure but also in innovation, talent, and product differentiation—further increasing costs and risks in an already expensive race.

Analysts: AI Is a Long-Term Bet, Not a Quick Win

• Multi-year investment cycle

• 2026 seen as potential turning point

• Short-term pain likely to continue

Market analysts stress that artificial intelligence represents a multi-year transformation, not an overnight success story. Several experts believe 2026 could be a key inflection point when AI investments begin to generate stronger financial returns. Until then, Microsoft may face ongoing pressure from investors who are wary of rising costs and delayed monetisation. The market is increasingly shifting toward a “winners and losers” phase, evaluating which companies can sustainably convert AI innovation into profits.

Broader Market Reaction and Economic Backdrop

• Tech sector volatility increases

• Risk appetite weakens

• Growth expectations cool

The sell-off in Microsoft shares contributed to broader market volatility. Technology stocks weakened, and investors adopted a more cautious stance toward risk assets. At the same time, recent economic data has slightly cooled expectations for US growth, adding to the downbeat sentiment. In this environment, companies with heavy spending commitments—particularly in capital-intensive areas like AI infrastructure—are facing heightened scrutiny from the market.

AI Potential Remains Strong, but Risks Are Rising

• Long-term opportunity intact

• Short-term uncertainty dominates

• Investor patience under test

Microsoft’s long-term vision for artificial intelligence remains compelling, but the recent market reaction shows that investors are no longer willing to overlook the costs, risks, and timelines associated with AI expansion. Heavy capital spending, reliance on OpenAI, and uncertainty around monetisation have placed the stock under pressure. While AI could transform industries over time, Microsoft—and the broader tech sector—must now prove that these massive investments can translate into sustainable financial returns.

WMT Stock Soars Today as Walmart Shares Rally

Walmart Inc. (NYSE: WMT) continues to attract massive attention from investors as its stock price…

Best Alphabet’s Massive 2026 AI Spending Stuns Wall Street

Alphabet Goes All-In on Artificial Intelligence Alphabet Inc., the parent company of Google, has unveiled a massive…

Meta Shares Skyrocket as Company Reports Historic Sales Growth

Meta said its capital expenditures could nearly double to $135bn this year as part of…

Creative Confidence: Gerard Way’s Take on Business Growth

Growing a lifestyle business is a blend of passion, creativity, and smart strategy. Gerard Way—musician,…

Easy Guide to Buying Samsung Galaxy S25 from the US

The Samsung Galaxy S25 series is one of the most talked-about phone launches of the year, and many…

From Couture to Culture: Valentino’s Luxury Story

There are luxury fashion houses, and then there are names that feel like pure legacy….

Disclaimer: This content is for informational and educational purposes only. It does not constitute financial, investment, or trading advice. Market conditions and company performance can change rapidly. Readers are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

#Microsoft #AIInvestments #TechStocks #WallStreet #CloudComputing#Azure #OpenAI #BigTech #StockMarket #ArtificialIntelligence

#MarketAnalysis #TechNews #Nasdaq #AIInfrastructure#Carrerbook#Anslation